Financial Advisory

Valuations

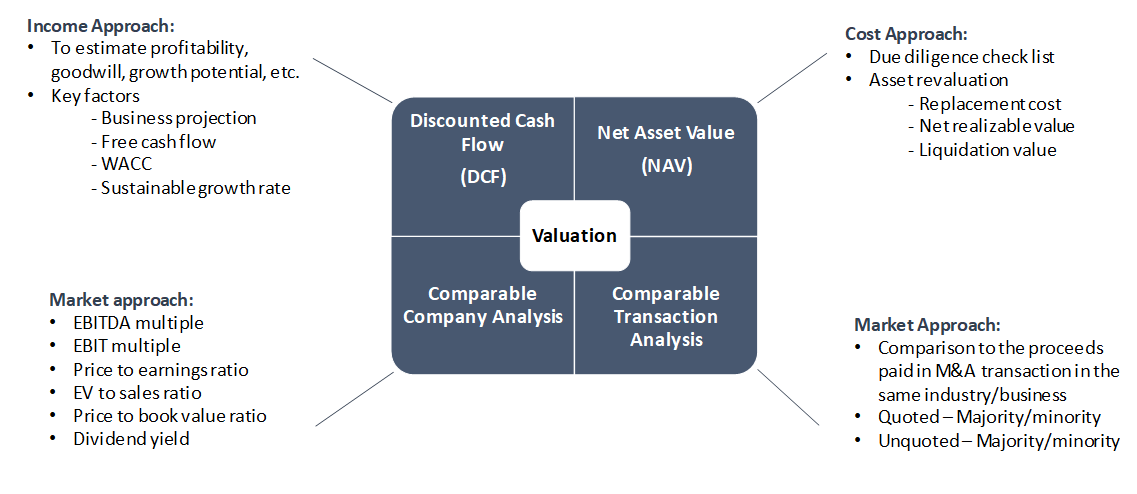

We tailor the scope of our business valuations to our client’s specific needs and the purpose of the engagement. As per requirements, our valuation reports provide an overview of the company, industry, economy, and value drivers. They also include the analyses performed, along with the inputs and assumptions, that support the final valuation.

Debt Advisory

Bank financing is the most common form of business financing available to companies. We leverage the experience of our team in arranging various types of debt financings for our clients through a wide range of local, regional and international lending institutions. We also assist our clients in restructuring of existing borrowing facilities.

Actuarial Valuation of End-of-Service Benefits (EOSB)

- In the context of employee benefits, there are various reasons why you may need an actuarial valuation. The most common reason

is to prepare year-end financial statements. - The International Financial Reporting Standard 19 (IFRS 19) prescribes the accounting and disclosure for employee benefits.

The Standard requires an entity to recognize: a liability when an employee has provided service in exchange for employee benefits

to be paid in the future; and an expense when the entity consumes the economic benefit arising from service provided by an

employee in exchange for employee benefits. - Defined benefit plans are classified as post-employment plans where the obligation of the entity is to provide the agreed benefits to

current and former employees, usually based on some benefit formulas. - Under defined benefit plans, actuarial risk and investment risk fall, in substance, on the entity. If actuarial and investment

experience is worse than expected, the entity’s obligation may be increased.